Become a Member of Art Encounter

Being an Art Encounter member means joining a community of art-lovers from around the country, gaining first-hand exposure to new artists and art movements through our programs, and receiving access to exclusive behind-the-scenes art experiences. Membership also supports our mission to bring art to people of all ages and backgrounds, so your giving gives back to others!

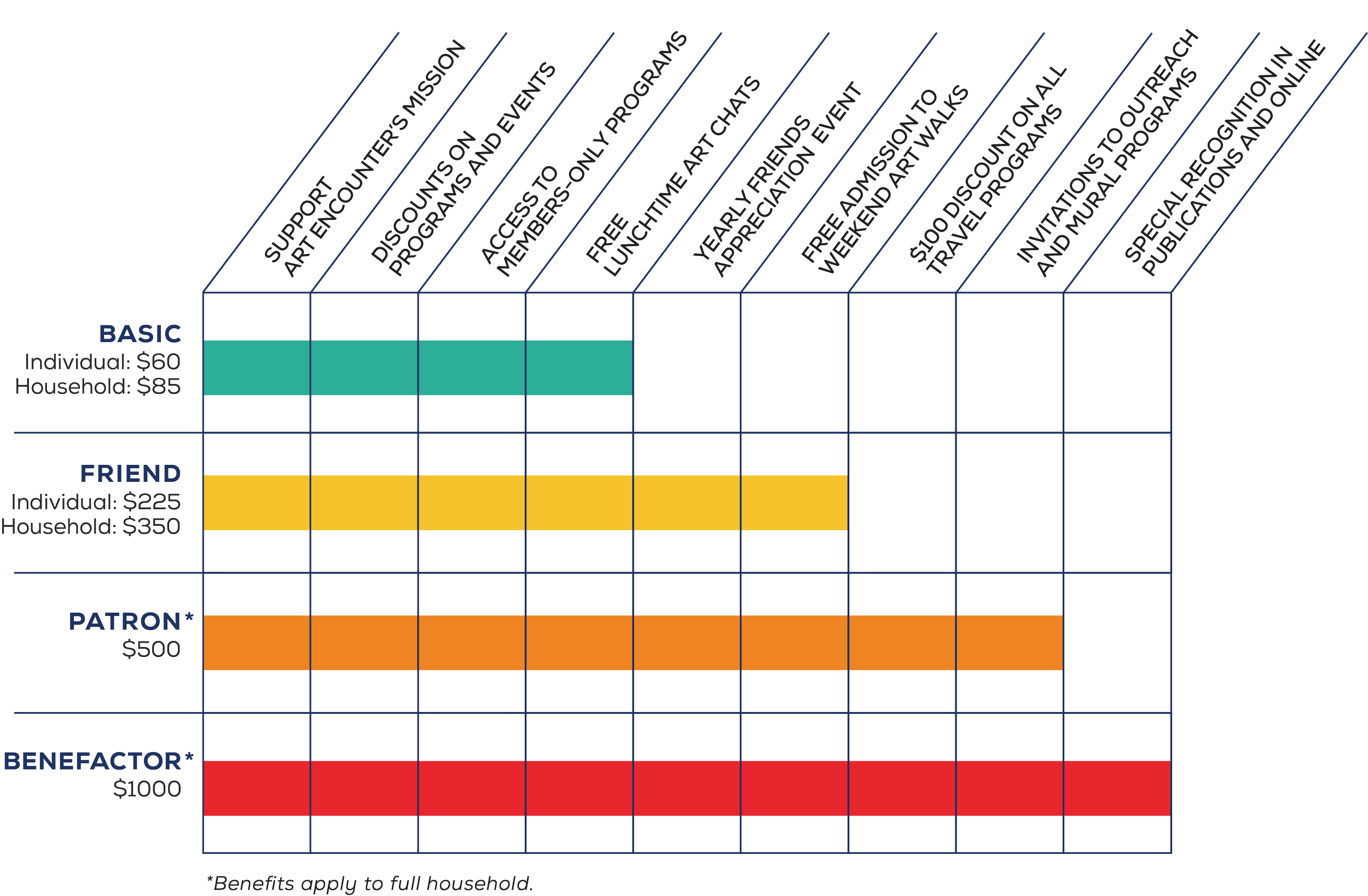

Our membership year runs from July 1–June 30; all memberships purchased now will be active until June 30, 2026. Use the chart below to choose your membership level, then use the links below to join or renew online.

To view highlights from our last year of membership, check out our Membership Year in Review!

We have a lot of exciting plans in store for the coming year, including:

Discounts and special access to public programs, including exclusive visits to artists’ studios, exhibitions, and private collections to keep you on the pulse of what’s hot in art right now.

Ongoing online programs featuring conversations with local artists and explorations of global art history topics to reach all of our members across the country.

An exciting trip to Denmark this September to explore the country’s unique art scene, distinctive architecture, and incredible cuisine

A number of FREE Special Member Experiences, including our annual Members Appreciation Event, Friends Appreciation Event, and online Lunchtime Art Chats.

NEW! Reciprocal membership benefits with the Evanston Art Center. See below for details.

Reciprocal Membership Benefits with the Evanston Art Center

Art Encounter and the Evanston Art Center are joining forces to offer shared benefits to their members, celebrating their mutual dedication to art, education, and community. As part of this collaboration, Art Encounter members can enjoy the perks of an EAC student membership, which includes discounts on EAC classes, workshops, and special arts-related programming.

To learn more about current and upcoming Evanston Art Center classes, visit evanstonartcenter.org. All Art Encounter members may take advantage of reciprocal EAC membership benefits by registering for discounted classes over the phone or in person at the EAC front desk. (EAC cannot process AE discounts through online registration at this time.) Feel free to email us at info@artencounter.org with any questions.

MEMBERSHIP LEVELS

Memberships are tax deductible as permitted by law.

BASIC LEVEL BENEFITS:

• Discounts on Programs and Events

Discounts on in-person and online programs including Summer Series, Winter Series, Night Visions, and more.

• Access to Members-Only Programs

Registration access to members-only programs including Expanding Visions and all Art Encounter Travel.

• Yearly Member Appreciation Event

Invitation to our annual Member Appreciation Event. Enjoy refreshments and conversation with other art-lovers while visiting an artist studio, private collection, or unique exhibition space.

• Lunchtime Art Chats

Join us for Lunchtime Art Chats, our online interviews with local muralists, gallerists, collectors, and auctioneers.

FRIENDS LEVEL BENEFITS:

All Basic-Level Membership Benefits plus...

• Yearly Friends Appreciation Event

Invitation to our annual Friends Appreciation Event. Enjoy refreshments and conversation with other art-lovers while enjoying a unique and exclusive art experience.

• Free Admission to Weekend Art Walks

Join us on select Saturdays to discover new ideas and a variety of artistic media at local galleries.

PATRON LEVEL BENEFITS:

All Friend-Level Membership Benefits plus...

• $100 Discount on All Travel Programs

A discount of $100 per household per trip for all Art Encounter Travel.

• Special Invitation to Outreach and Mural Programs

Witness the magic of our outreach programming with local public school students by joining us for an in-school program or field trip. Attend special ribbon-cutting ceremonies for new mural projects.

BENEFACTOR LEVEL BENEFITS:

All Patron-Level Membership Benefits plus...

• Special Recognition in Publications and Online

Benefactors will be honored with special recognition at events, in newsletters, on our website, and in brochures.